Vietnam’s commodity derivatives market is rapidly evolving, presenting significant opportunities and challenges for participants. This blog post aims to provide a comprehensive overview of the current state of the market, the regulatory landscape, and the avenues available for Vietnamese entities to engage in offshore commodity derivatives trading. Additionally, we will highlight the unique benefits of trading on the Mercantile Exchange of Vietnam (MXV), making a compelling case for why it should be the preferred platform for commodity derivatives trading.

I. Overview

A commodity derivative is a financial product whose value is derived from the value of an underlying commodity. At maturity, these transactions can be settled either by cash netting or by delivering the underlying commodity. Common types of commodity derivatives include futures/forward contracts, option contracts, and swap contracts. These products can be traded through exchange platforms or over-the-counter (OTC).

Derivative trading in Vietnam is governed by stringent regulations encapsulated within frameworks like the FX Ordinance and Circular 211. These regulations restrict derivative trading exclusively to licensed credit institutions, encompassing a broad spectrum from commercial banks to finance leasing companies. However, exceptions exist within these rules. Non-credit institutions, such as local corporations, may engage in derivative trading with offshore counterparts but must secure approval from the State Bank of Vietnam (SBVN). Notably, the absence of clearly defined procedures for obtaining SBVN approval has effectively hindered non-credit institutions from participating in such transactions.

Moreover, international derivative trading is classified as a specialized form of foreign exchange activity. Credit institutions intending to engage in such activities must acquire a Special Foreign Exchange Permit (Special FX Permit) from the SBVN. This permit delineates the permissible types of derivative transactions and their duration. Nevertheless, there are exceptions to this requirement. Derivative products like interest rate swaps and commodity derivatives, subject to specific trading rules established by the SBVN, do not mandatorily require a Special FX Permit. Presently, interest rate swaps and commodity derivatives are among the exempted products under these regulations.

Furthermore, commodity derivative transactions in Vietnam are subject to dual oversight. Beyond the purview of SBVN regulations, transactions conducted through the Mercantile Exchange of Vietnam (MXV), the national centralized commodity exchange, adhere to a distinct regulatory framework. These regulations provide additional guidelines and standards governing commodity derivative activities within Vietnam’s financial landscape.

II. Regulation Framework

i. Regulation by Banks

Circular 402 outlines the regulations governing the trading of commodity derivatives by Vietnamese commercial banks and branches of foreign banks (“Banks”). According to these guidelines, a Special FX Permit is not necessary for trading commodity derivatives. The rules specify the following key points:

Firstly, commodity derivative products are defined in Article 3 of Circular 40 as financial instruments provided by Banks primarily for hedging purposes. Article 5 of the same circular stipulates that trading in derivative products is contingent upon their use for hedging purposes, explicitly prohibiting speculative trading.

Secondly, under Circular 40, only Banks are authorized to act as vendors of commodity derivatives. While a Special FX Permit is not a prerequisite, Banks must possess incorporation and operational licenses that authorize basic foreign exchange activities and dealings in commodity derivatives. This requirement is routinely fulfilled by most commercial banks operating in Vietnam.

Additionally, counterparties engaging in commodity derivative transactions with Banks must meet specified criteria outlined in Circular 40. These counterparties include Vietnamese enterprises engaging Banks as customers for commodity derivative transactions and foreign parties entering into transactions with Banks to offset positions.

Moreover, Circular 40 outlines that eligible underlying commodities for derivative transactions must fall into categories such as agricultural products, fuels, energy, or metals. Notably excluded are commodities like gold and those subject to trading, export, or import restrictions.

ii. Regulation by MXV

The second set of regulations pertains to the Mercantile Exchange of Vietnam (MXV), the sole centralized commodities trading platform in the country, licensed under the Ministry of Industry & Trade (MOIT). Rules governing commodity derivatives trading through MXV are outlined in Decree 1583.

Eligible parties: According to Decree 158, only members of MXV, such as commodity traders and brokers, are authorized to offer commodity derivatives products as vendors. These members must meet specified criteria including legal capital requirements and infrastructure standards set by MXV. Presently, MXV has granted approval to 33 commodities traders and one commodity broker.

Any enterprise or individual may engage MXV members to trade commodity derivatives. Such customers must conduct transactions through an account opened with an MXV member and maintain an escrow amount to ensure transaction security. The escrow amount typically equals or exceeds 5% of the proposed transaction value, varying based on transaction specifics and the trader or broker involved.

Eligible products: Under Decree 158, only commodities registered or notified to MOIT by MXV are eligible for trading. Moreover, only specific types of commodity derivatives products are permitted for trading, details of which are elaborated in Section IV of the decree.

Trading purpose: In contrast to bank hedging transactions, MXV allows commodity derivatives trading without restrictions on the purpose. MXV members may engage in trading for speculative purposes, hedging, or on behalf of their customers, providing flexibility in trading strategies.

iii. Access to Global Futures Exchanges via Banks & MXV

a. Via Banks

Under agreements such as the EU-Vietnam Free Trade Agreement (EVFTA) or the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), Vietnam’s obligations regarding derivative products in cross-border trade remain unrestricted. Hence, Vietnamese law governs these transactions.

Trading through offshore commodity exchanges via Banks is permitted under Circular 40, allowing Banks to trade on behalf of Customers. However, foreign banks operating in Vietnam are not granted this privilege unless they operate through a licensed branch in the country.

Only commodity futures products and commodity option products, encompassing call and put options, are eligible for trading on offshore commodity exchanges. Additionally, the maturity of these commodity derivative products must not exceed the remaining term of the underlying contract.

To qualify, Customers must fulfill several conditions: they must possess a valid underlying contract for the commodity derivatives, trade exclusively for hedging purposes, and meet the financial viability standards set by the Banks to ensure transaction settlement.

When entering into commodity derivatives agreements with Banks, Customers are required to utilize an escrow account to fulfill their obligations. Notably, the minimum balance for this account is not stipulated by regulation but is determined by mutual agreement between the parties involved and the requirements of the offshore commodity exchange.

b. Via MXV

According to Decree 158, an MXV member is authorized to trade on an offshore commodity exchange either for its own account or on behalf of its Customers, with which holding a local bank account with foreign passport.

Eligible Customers under Decree 158 include traders, who may be any enterprise or individual holding a business registration license. These traders are permitted to engage in various trading activities such as import and export, provided the commodities involved are not restricted for trading purposes.

Decree 158 does not specify whether banks qualify as Customers to engage MXV members for commodity derivatives trading. Similarly, Circular 40 does not address situations where Banks trade on offshore commodity exchanges through MXV. It appears that SBVN regulations do not intend to allow banks to participate in commodity derivatives trading via MXV, viewing Banks and MXV as fulfilling similar roles under their respective regulations.

MXV members and their Customers can engage in trading commodity derivative products on offshore exchanges, contingent upon MXV and the offshore exchange having a mutually agreed interconnection arrangement. Such agreements must be reported to MOIT for approval. As of the latest information available, MXV has established interconnection partnerships with several offshore commodity exchanges, including:

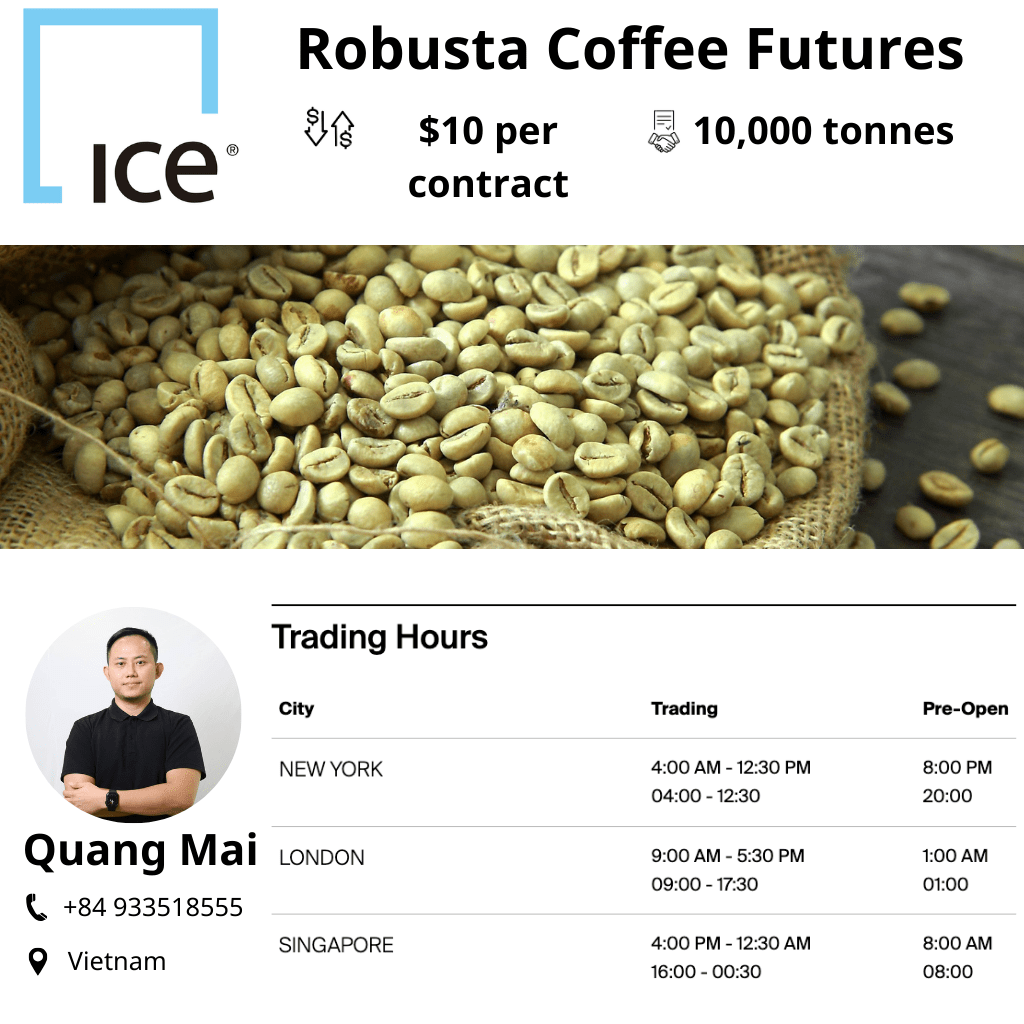

- Intercontinental Exchange (ICE), including ICE EU, ICE US, and ICE SG;

- Bursa Malaysia Derivatives Exchange (BMDX);

- London Metal Exchange (LME)

- Chicago Commodity Exchange (CME Group), including CBOT, COMEX, and NYMEX;

- Osaka Securities Exchange (OSE); and

- Singapore Commodity Exchange (SGX).

c. Commodities available for trading via MXV

As mentioned in Section III, only certain commodities, which have been notified/registered with the MOIT by the MXV, are permitted for trading purposes. Currently, 38 types of commodities are permitted, including:

- Agricultural products: corn, mini-corn, soybean, mini-soybean, soybean oil, soybean meal, wheat, mini-wheat, Kansas wheat, and rough rice;

- Industrial raw materials: Robusta coffee, Arabica coffee, cocoa, sugar 11, white sugar, cotton, RSS3 rubber, TSR20 rubber, and crude palm oil;

- Metals: platinum, silver, copper, iron ore, copper LME, aluminum LME, lead LME, tin LME, zinc LME, nickel LME, e-mini copper, micro copper, e-mini silver, and micro silver; and

- Energy: Brent crude oil, mini Brent crude oil, WTI crude oil, e-mini WTI crude oil, micro WTI crude oil, natural gas, low sulfur gasoil, RBOB gasoline, and e-mini natural gas.

According to Decree 158, upon maturity, Customers have the option to settle commodity derivatives transactions through cash netting. Currently, delivery of the underlying commodity is not permitted via MXV in Vietnam. Cash netting transactions are typically processed through an MXV clearing house, facilitating efficient bank transfers, particularly for outbound remittances.

For effective guidance and assistance in navigating these complexities and opening accounts efficiently, Contact a certified broker to assist with account opening and 1:1 consultation.