Investing in EV Stocks vs. Commodities: A Comprehensive Analysis for Optimal Returns

The world of investments is filled with opportunities and risks, each offering unique advantages and challenges. Among the various sectors available to investors, the electric vehicle (EV) market and the commodities market are particularly prominent. Both sectors have shown significant potential for high returns but also come with their own set of risks. This blog post aims to provide a comprehensive analysis of investing in EV stocks versus commodities, delving into historical performance, volatility, risk factors, and strategic insights to help investors make informed decisions.

Historical Performance and Market Trends

Understanding the historical performance of both markets provides a foundation for assessing future potential. Let’s examine the trends over the past two decades.

EV Market Performance:

The EV market has been characterized by rapid growth and significant volatility. The sector has seen the rise of innovative companies like Tesla, which have driven substantial returns for early investors. However, the market is also littered with companies that have faced severe financial difficulties, leading to massive losses and bankruptcies.

- High Growth Potential: Companies like Tesla have seen their stock prices soar, reflecting strong investor confidence in the future of electric vehicles. Tesla, for instance, has transformed from a niche player to a market leader, achieving substantial market capitalization.

- High Volatility and Risk: The data shows that many EV companies have experienced dramatic declines in stock value. The chart highlights several bankruptcies, with companies like Fisker, Lordstown, Proterra, Arcimoto, and Arrival suffering 100% losses from their highs. Even surviving companies have faced steep declines, with losses ranging from 55% to 99.997%.

- Technological and Market Uncertainty: The EV sector is still evolving, with technological advancements and regulatory changes playing crucial roles. While this offers opportunities for growth, it also introduces uncertainties that can impact stock performance.

Commodity Market Performance:

The commodities market has experienced significant fluctuations over the past two decades, influenced by global economic conditions, geopolitical events, and supply-demand dynamics.

- Bull and Bear Cycles: The commodity market has witnessed distinct bull and bear phases. For example, the energy crisis from 2003 to 2008 saw a significant increase in commodity prices, driven by rising demand and supply constraints. Conversely, the 2014-2016 period experienced a sharp decline in oil prices, reflecting changes in supply dynamics and geopolitical tensions.

- Growth Rates and Volatility: The commodity market has shown periods of substantial growth, with annual growth rates occasionally exceeding 80%. However, it is also highly volatile, with prices sensitive to external factors such as geopolitical events, economic crises, and natural disasters.

- Intrinsic Value: Commodities like oil, gold, and agricultural products have intrinsic value linked to their physical utility and demand. This can provide a degree of stability and a safety net during economic downturns.

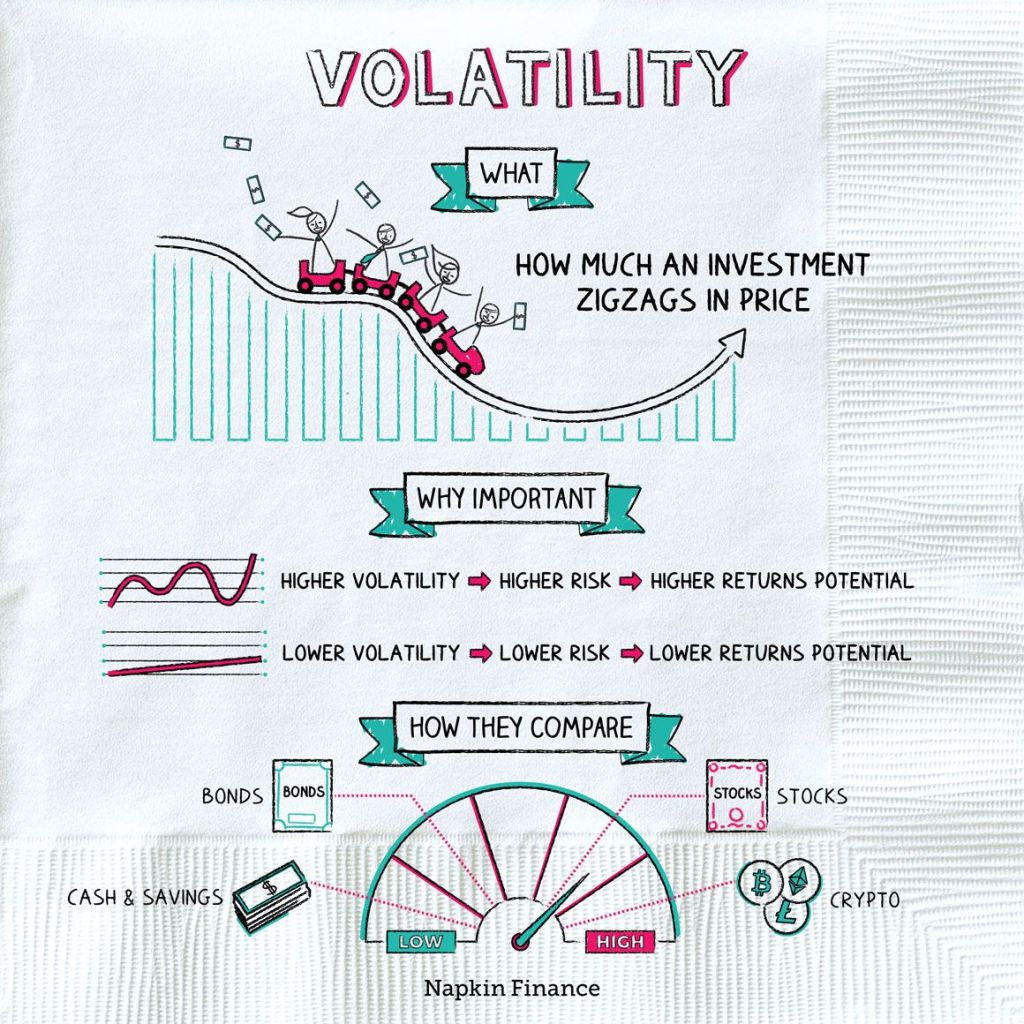

Volatility and Risk Analysis

Volatility and risk are critical factors to consider when evaluating investment opportunities. Both the EV market and the commodities market exhibit high volatility, but the nature and sources of this volatility differ.

EV Market Volatility:

- Company-Specific Risks: The EV market’s volatility is often driven by company-specific factors, such as technological advancements, production challenges, and competitive pressures. For example, the success or failure of a new vehicle model can significantly impact a company’s stock price.

- Regulatory Changes: Government policies and regulations related to emissions standards, subsidies, and incentives for electric vehicles can also influence market dynamics. Regulatory uncertainty can lead to significant fluctuations in stock prices.

- Market Sentiment: Investor sentiment plays a crucial role in the EV market. Positive news about technological breakthroughs or partnerships can drive stock prices up, while negative news about financial performance or production delays can lead to sharp declines.

Commodity Market Volatility:

- Global Economic Conditions: Commodity prices are closely linked to global economic conditions. Economic growth can drive demand for commodities, leading to price increases, while economic downturns can reduce demand and cause prices to fall.

- Geopolitical Events: Geopolitical events such as conflicts, trade disputes, and sanctions can disrupt supply chains and impact commodity prices. For instance, the Russian invasion of Ukraine in 2022 led to significant price fluctuations in energy markets.

- Supply-Demand Dynamics: Changes in supply-demand dynamics, such as production cuts by major producers or shifts in consumption patterns, can lead to substantial price movements. For example, the COVID-19 pandemic caused a sharp decline in oil prices due to reduced demand.

Resilience and Stability

Resilience and stability are important considerations for long-term investors. Both the EV market and the commodities market have shown resilience in different ways, but they also face unique challenges.

EV Market Resilience:

- Innovative Companies: Market leaders like Tesla have demonstrated resilience by continuously innovating and expanding their market presence. These companies have managed to navigate technological and market challenges, achieving significant growth.

- Strategic Partnerships: Collaborations and partnerships with other companies, including traditional automakers and technology firms, can enhance resilience by pooling resources and expertise.

- Government Support: Government policies and incentives aimed at promoting electric vehicles and reducing carbon emissions can provide a supportive environment for the EV market. However, changes in government policies can also introduce risks.

Commodity Market Resilience:

- Intrinsic Value: Commodities have intrinsic value based on their physical properties and utility. This can provide a degree of stability during economic downturns, as there is always a basic demand for essential commodities like oil, gold, and agricultural products.

- Diversification: Investing in a diverse range of commodities can help mitigate risks associated with individual commodities. For example, while energy commodities may be volatile, agricultural commodities may offer more stability.

- Hedging and Risk Management: Commodities are often used as hedges against inflation and currency fluctuations. Investors can use commodity futures and options to manage risk and enhance portfolio resilience.

Strategic Investment Insights

Investing in the EV market and the commodities market requires different strategies and considerations. Here are some key insights to help investors navigate these markets:

1. Diversification:

- Balance Risk and Reward: Diversifying your portfolio across both EV stocks and commodities can help balance risk and reward. While EV stocks offer high growth potential, commodities provide a hedge against economic and geopolitical risks.

- Sector Diversification: Within the EV market, consider diversifying across different companies, including market leaders and promising startups. In the commodities market, diversify across different types of commodities, such as energy, metals, and agricultural products.

2. Long-Term Perspective:

- EV Market: The EV sector is still in its early stages, with significant growth potential driven by the global shift towards sustainable energy. Investors should have a long-term perspective, focusing on companies with strong fundamentals and innovative capabilities.

- Commodity Market: Commodities are influenced by long-term economic and geopolitical trends. A long-term perspective allows investors to navigate short-term volatility and capitalize on long-term growth opportunities.

3. Stay Informed:

- Market Trends: Keep abreast of market trends, technological advancements, and regulatory changes. Staying informed allows investors to make timely decisions and adapt to changing market conditions.

- Economic Indicators: Monitor key economic indicators, such as GDP growth, inflation rates, and employment data, to understand the broader economic environment and its impact on commodity prices.

4. Assess Financial Health:

- EV Companies: Evaluate the financial health of EV companies by examining their cash flow, debt levels, revenue growth, and profitability. Companies with strong financials are better positioned to withstand market challenges and achieve long-term growth.

- Commodity Investments: Assess the financial stability of commodity producers and suppliers. Consider factors such as production costs, reserves, and geopolitical risks that may impact their operations.

5. Risk Management:

- Hedging Strategies: Use hedging strategies, such as commodity futures and options, to manage risk and protect against price fluctuations. Hedging can provide stability and enhance portfolio resilience.

- Portfolio Rebalancing: Regularly review and rebalance your portfolio to ensure it aligns with your investment goals and risk tolerance. Rebalancing helps maintain a diversified and balanced portfolio.

Conclusion

Investing in the EV market and the commodities market offers distinct opportunities and challenges. The EV market, characterized by high growth potential and significant volatility, requires a long-term perspective and careful selection of resilient companies. In contrast, the commodities market, influenced by global economic conditions and geopolitical events, offers intrinsic value and diversification benefits.

To optimize returns and balance risks, investors should consider a diversified portfolio that includes both EV stocks and commodities. By staying informed, assessing financial health, and implementing risk management strategies, investors can navigate these dynamic markets and achieve their financial goals. Ultimately, the choice between EV stocks and commodities depends on individual risk tolerance, market knowledge, and long-term investment objectives.