Understanding the intricate relationship between climatic events and coffee prices is crucial for coffee derivatives traders. The Sucafina’s report sheds light on how ENSO (El Niño-Southern Oscillation) phases influence global temperature trends, which, in turn, affect coffee production and market prices. Let’s dive deeper into the correlation between these climatic events and coffee prices, providing a comprehensive analysis for traders.

Analyzing the Climate Data

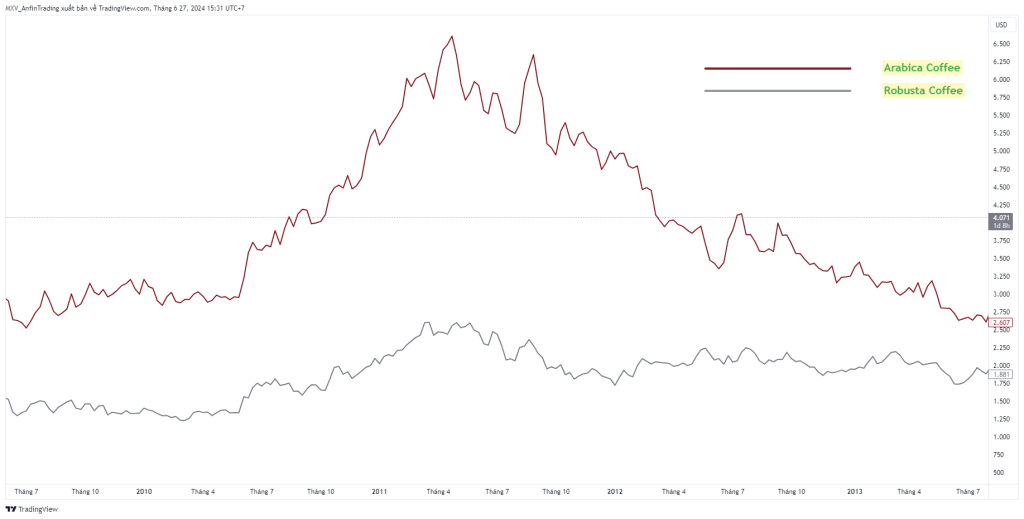

The image presents two critical pieces of information:

- Global Average Temperature Change (1950-2020):

- This graph shows the average global temperature changes over several decades, categorized by ENSO phases.

- Strong El Niño years (marked in red) consistently show significant temperature increases.

- La Niña years (marked in blue) show cooler temperatures but do not revert to the pre-warming baseline.

- Global Land and Ocean Temperature Anomalies (1980-2024):

- This graph illustrates the 12-month average temperature anomalies, highlighting strong El Niño and La Niña events.

- Notable temperature spikes correspond with strong El Niño years, while La Niña years show dips in temperature anomalies.

Correlation Analysis: Climate Events and Coffee Prices

El Niño Events and Coffee Prices:

- Impact on Weather: Strong El Niño events lead to significant warming, resulting in adverse weather conditions such as droughts in major coffee-growing regions like Brazil and Vietnam. These conditions can drastically reduce coffee yields.

- Impact on Coffee Prices: Reduced yields due to droughts lead to a supply shortage in the market, driving up coffee prices. Historical data shows that during strong El Niño years, coffee prices often experience a sharp increase due to these supply constraints.

The 1997/98 El Niño events saw substantial increases in global coffee prices as production in key regions was heavily impacted by drought.

The 2014/15 El Niño events saw substantial increases in global coffee prices as production in key regions was heavily impacted by drought.

La Niña Events and Coffee Prices:

- Impact on Weather: La Niña events bring cooler global temperatures and can lead to excessive rainfall and flooding in some coffee-growing areas. While these conditions can benefit certain regions, they can also disrupt harvesting and transportation.

- Impact on Coffee Prices: The effect on prices is more variable during La Niña years. While overall supply may be stable or even increase, localized weather extremes can create supply chain disruptions, leading to short-term price volatility.

The 2010/11 La Niña event caused excessive rainfall in Colombia, leading to crop diseases and reduced output, which resulted in temporary spikes in coffee prices.

Long-Term Warming Trend and Coffee Prices:

- Impact on Production: The long-term warming trend due to climate change poses a consistent threat to coffee production. Increased temperatures can lead to more frequent and severe droughts, altered growing seasons, and the proliferation of pests and diseases.

- Impact on Coffee Prices: This long-term trend contributes to increased uncertainty and risk in coffee production, potentially leading to higher average prices and greater volatility. Traders should anticipate that climate change will continue to exert upward pressure on coffee prices over time.

Strategic Implications for Traders

- Monitoring ENSO Forecasts:

- Regularly track ENSO forecasts from reliable sources. Understanding the upcoming phase (El Niño or La Niña) can help predict potential impacts on coffee production and prices.

- Adapting Trading Strategies:

- El Niño Years: Short position for potential price increases due to expected supply shortages. Consider long positions in coffee derivatives to capitalize on rising prices.

- La Niña Years: Be prepared for short-term volatility. Utilize options strategies to hedge against potential disruptions and take advantage of market fluctuations.

- Risk Management:

- Implement robust risk management strategies to protect against the adverse impacts of extreme weather events. Diversify investments across different coffee-growing regions to mitigate localized risks.

- Use weather derivatives and other financial instruments to hedge against climatic risks, ensuring a more resilient trading portfolio.

- Long-Term Considerations:

- Recognize the ongoing impact of climate change on coffee production. Invest in sustainable and climate-resilient coffee production practices to support long-term supply stability.

- Stay informed about climate research and advancements in agricultural technology that can help mitigate the effects of global warming on coffee crops.

The correlation between climatic events and coffee prices is clear: ENSO phases and long-term temperature trends significantly impact coffee production and market dynamics. By understanding these relationships, coffee derivatives traders can make more informed decisions, effectively manage risks, and capitalize on market opportunities.

As we navigate an era of increasing climatic variability, integrating climate intelligence into your trading strategy is not just advantageous—it’s essential. Stay informed, stay agile, and let climatic insights guide your path to success in the coffee derivatives market.